Corporate Financial Analysis

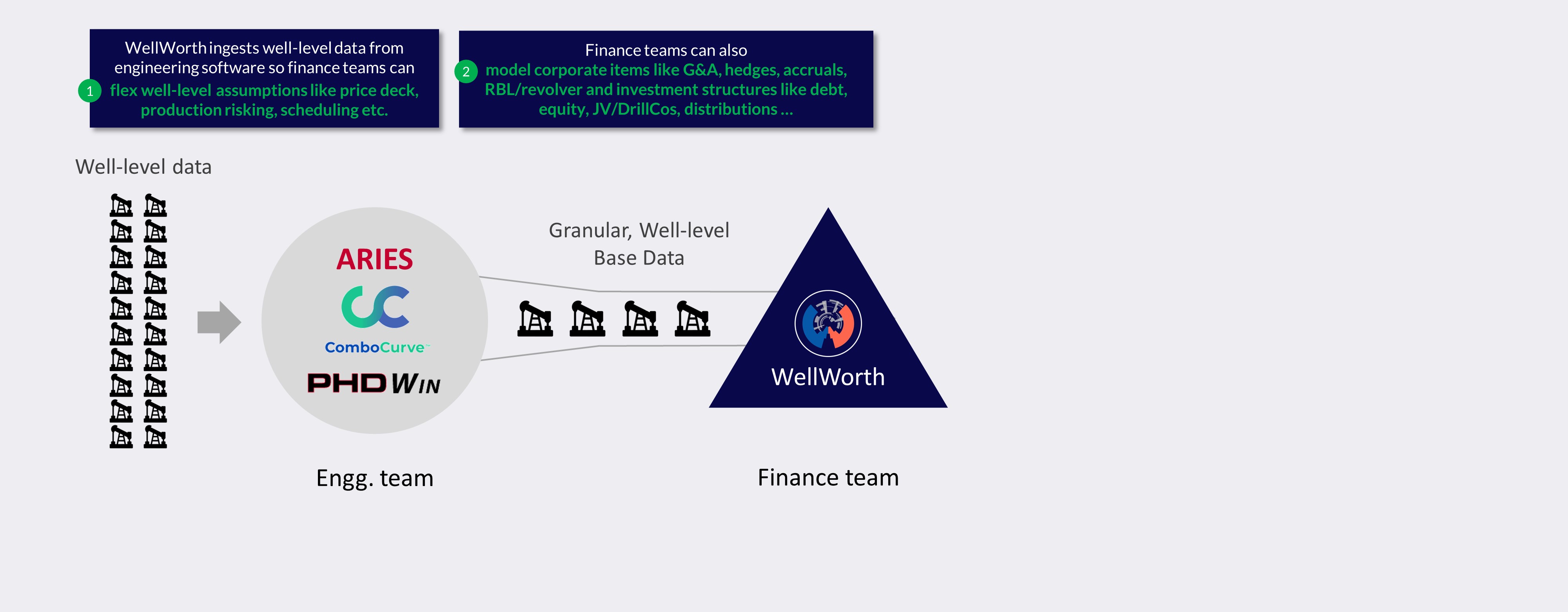

A powerful cloud-based platform

for NAV and corporate financial modeling

for upstream Oil & Gas finance teams

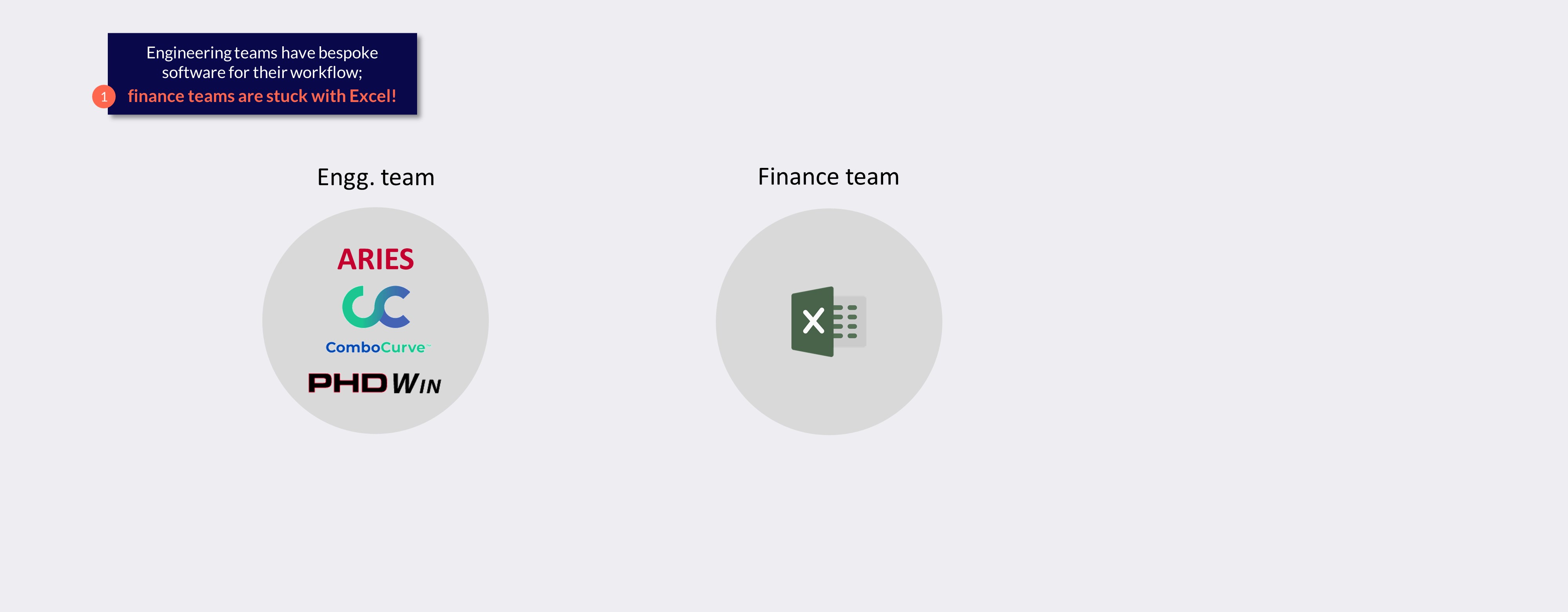

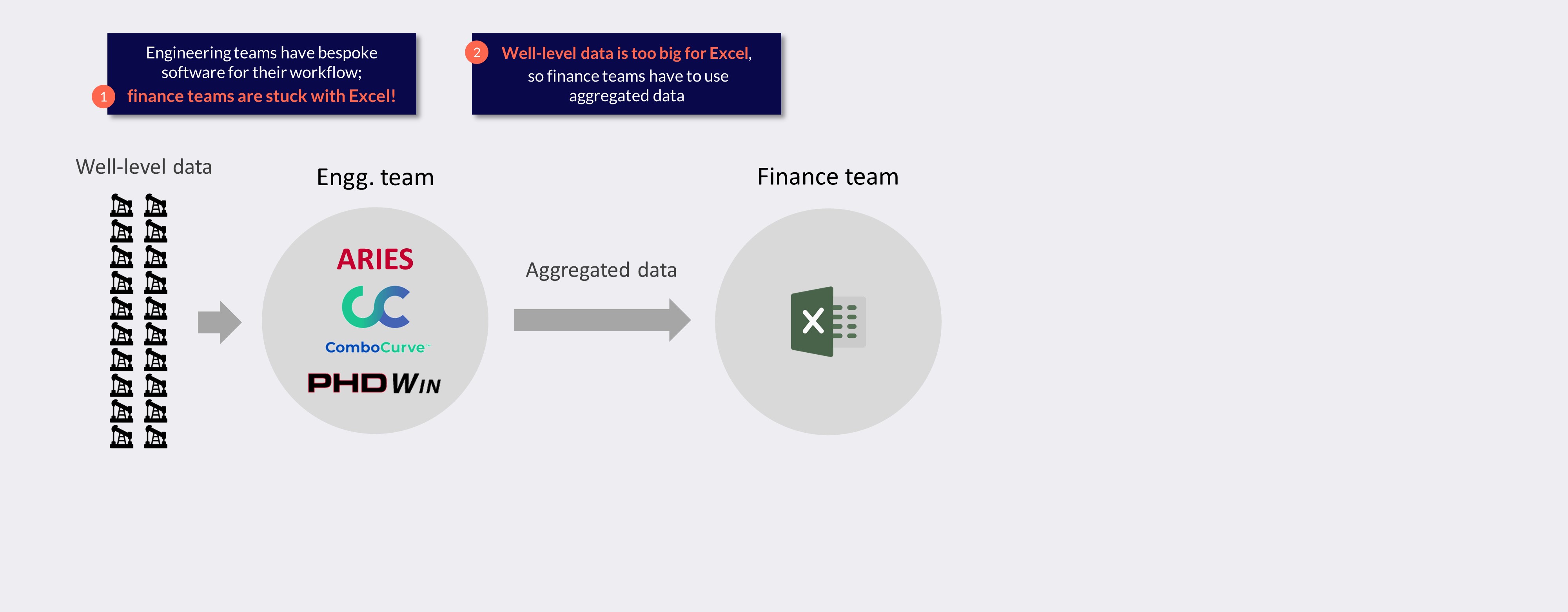

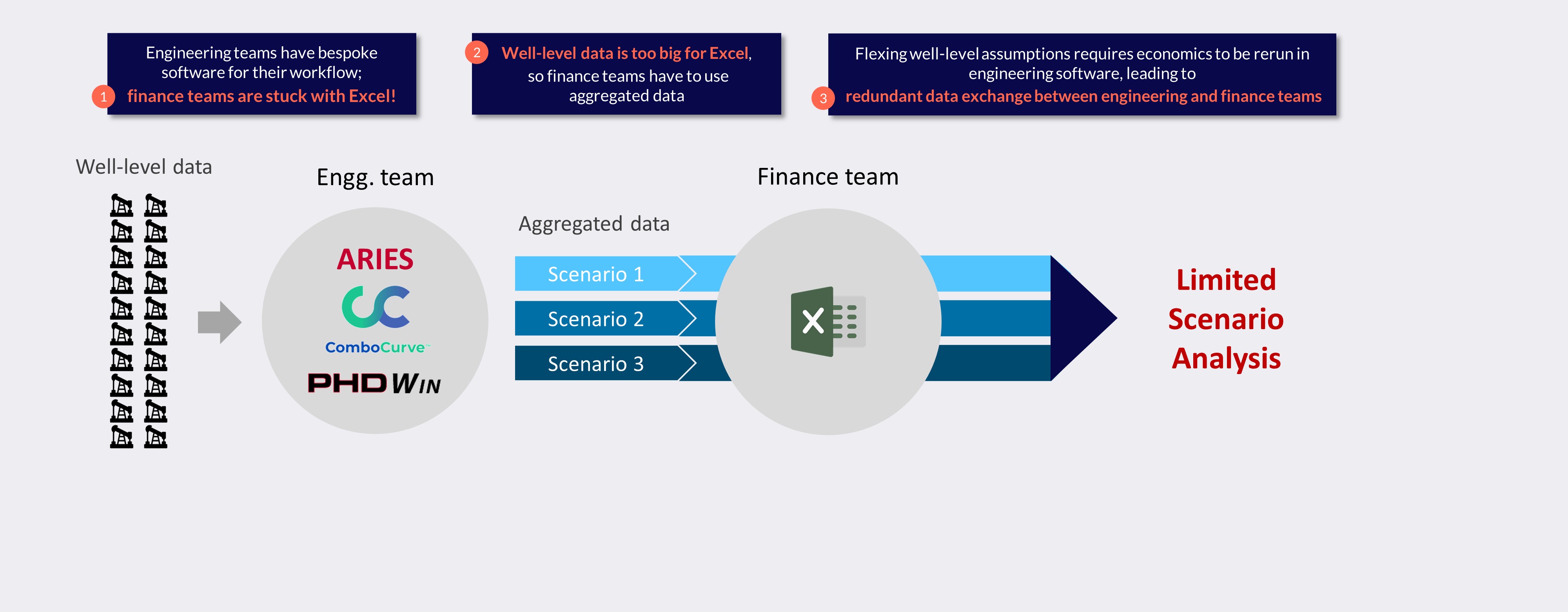

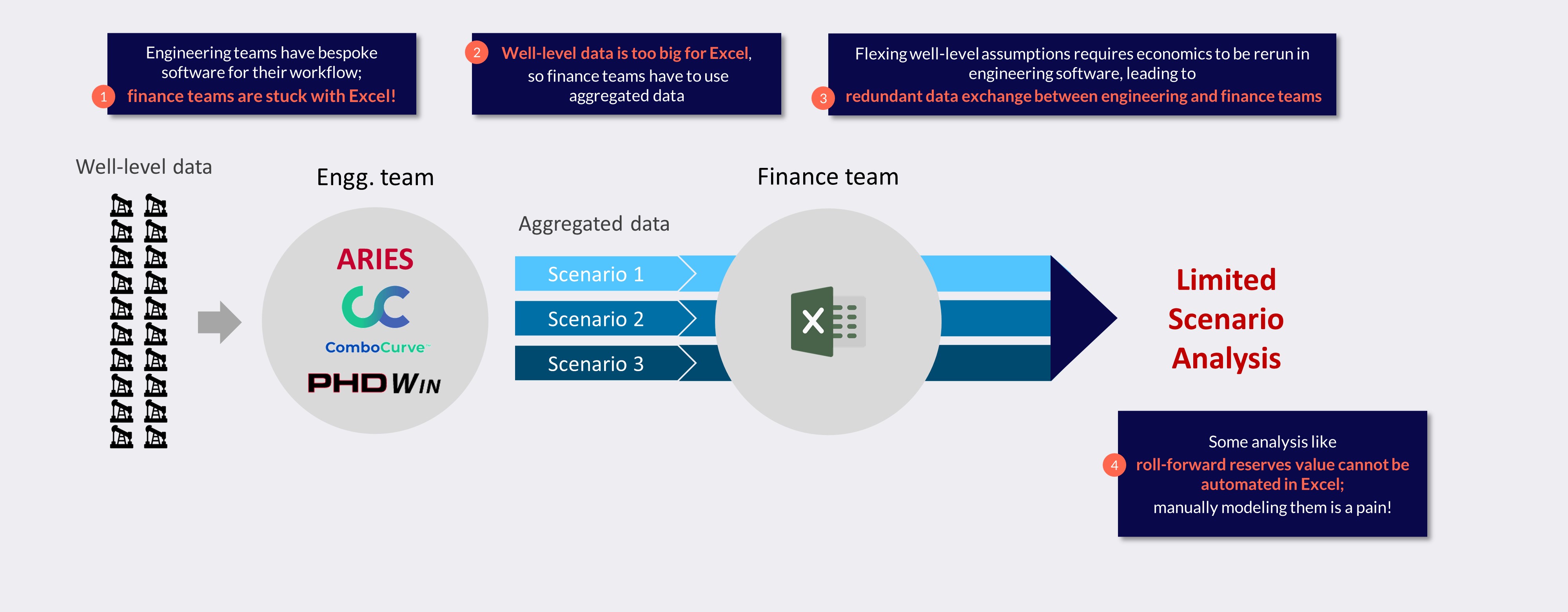

Problem Solution

Product

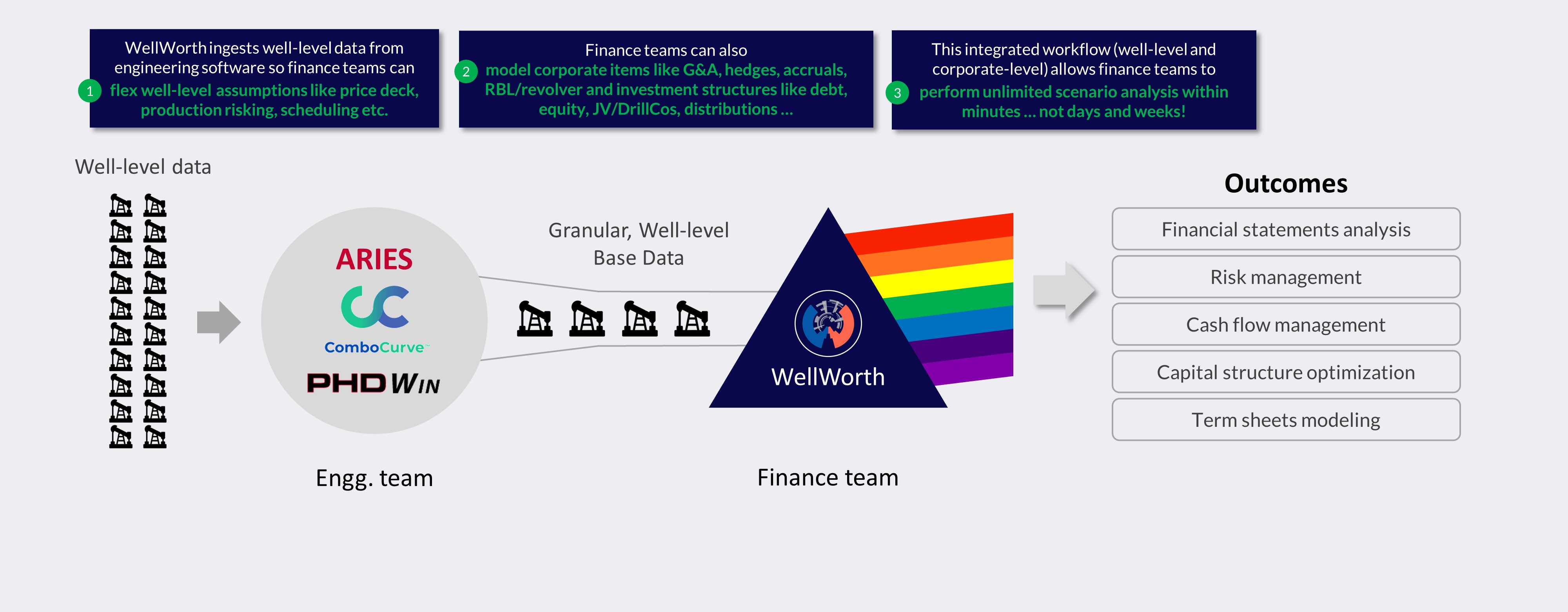

We can help you with the full financial modeling workflow

© 2025 WellWorth. All Rights Reserved.